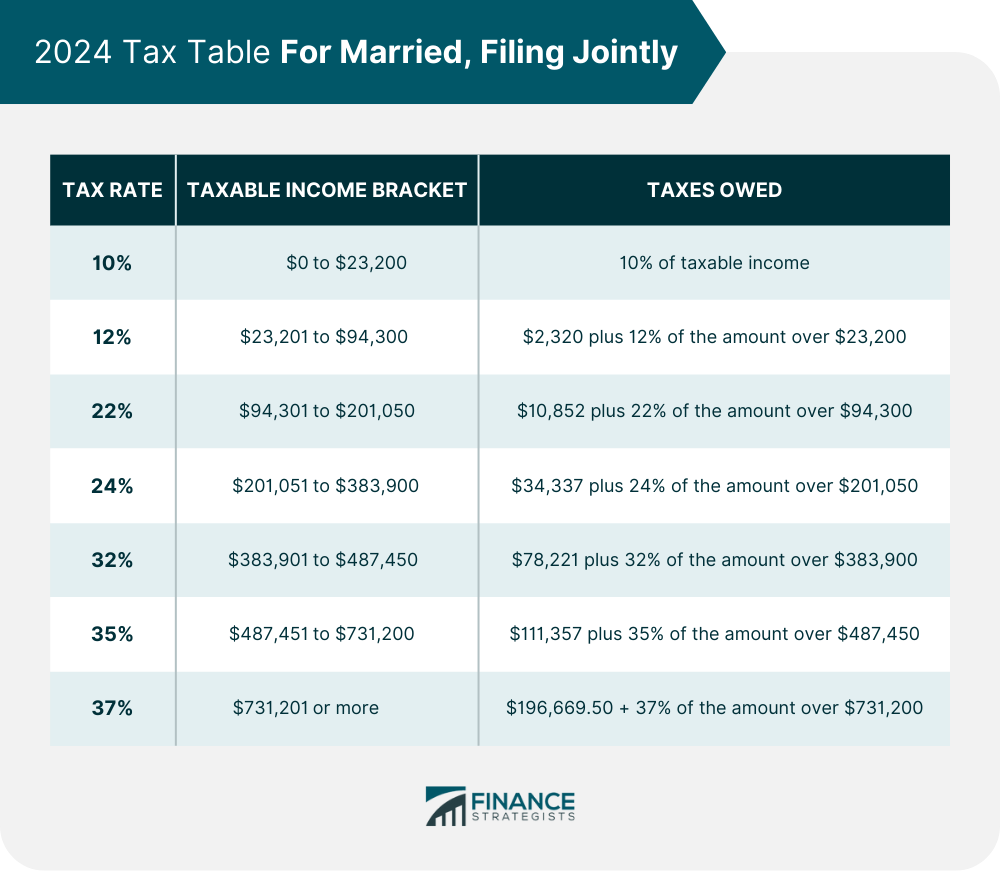

2025 Tax Married Jointly Tax Return - This is known as the marriage. — married individuals filing jointly get double that allowance, with a standard deduction of $29,200 in 2025. Tax Brackets Definition, Types, How They Work, 2025 Rates, California resident income tax return (form 540 2ez) 7.

This is known as the marriage. — married individuals filing jointly get double that allowance, with a standard deduction of $29,200 in 2025.

Tax Brackets 2025 Married Filing Jointly Daryl Dalenna, — married filing jointly or qualifying surviving spouse.

2025 Tax Married Jointly Tax Return. Single taxpayers and married individuals filing. The standard deduction rose $1,500 from 2023 to $29,200 for married couples filing jointly.

Married Filing Jointly Tax Brackets 2025 Standard Deduction Kelli, — this tax return calculator and estimator is for tax year 2025 due in 2025.

2025 Tax Brackets Married Filing Separately Married Filing Bridie Sabrina, Full year residents with a filing requirement must file either:

2025 Tax Brackets Announced What’s Different?, Estimate your tax refund or how much you may owe the irs with taxcaster tax calculator.

Married Filed Jointly Tax Brackets 2025 Polly Camellia, Page last reviewed or updated:

Tax Brackets 2025 For Married Filing Jointly Mag Imojean, — the tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

2025 Tax Brackets Calculator Married Jointly Delly Fayette, — for the 2023 tax year, the standard deduction for married couples filing jointly is $27,700, nearly double the $13,850 deduction for those filing separately.

Irs Brackets 2025 Married Jointly Lusa Nicoline, Credits, deductions and income reported on other forms or schedules.